This will mark my 4th review of the pattern of world trade over the past dozen years. Previous efforts described exports among twenty countries in 2013, 2016 and 2020. For the first time, I will use the World Integrated Trade data rather than rely on The Economist magazine’s World in Figures summary. As before, these numbers are about two years out of date, in this case summarizing the five main export partners of each country in 2022. Having access to complete world trade data presents an opportunity to ask new questions about the burgeoning trade alliance among the BRICS nations, including Brazil, Russia, India, China and South Africa. Unfortunately, data is only available for Russia in 2021. The key questions are 1) How has BREXIT changed world trade, 2) How important are non-G7 countries in world trade and 3) Where does world trade stand in advance of President Trump’s unilateral reforms?

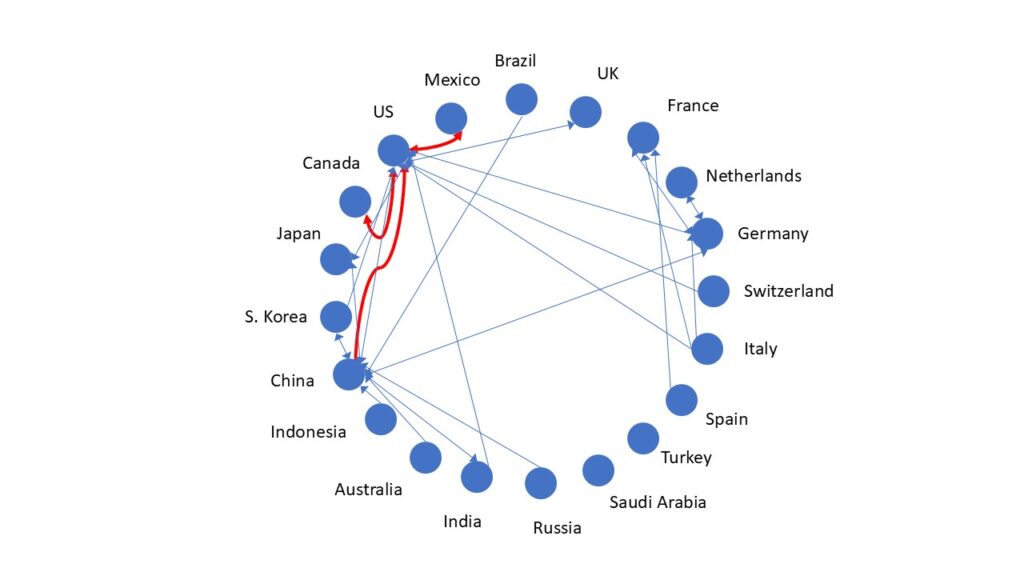

The four main trade flows among the US, Canada, Mexico and China have remained the same in the decade that I have been following trade. New in 2022 is a fifth flow greater than $250B, the export of US goods to Mexico. New relationships are showing up among the export markets greater than $50B. Indonesia, Switzerland and Spain have exports to a single country greater than $50B for the first time in 2022. Only Turkey and Saudi Arabia remain without links in this diagram.

Figure 1 shows an increasing isolation of the UK from its European trading partners. BREXIT and recovering economies in southern Europe have resulted in new flows within the European Union and less emphasis on exports from the continent to the UK. Despite efforts to establish new trading arrangements around the world, only the connection with the US has solidified in this period.

The growth of the BRICS trading block is illustrated by a new flow greater than $50 B from China to India. However it is plain to see from Table 1 that , with the exception of Brazil, all these countries export more to G7 countries (US, UK, France, Italy, Germany, Japan and Canada) than to the other four major BRICS countries.

Table 1: Exports by BRICS countries in billions of US dollars (2022).

| Country | Export to G7 | Export to BRICS |

| China | 1103 | 279 |

| Russia | 109 | 83 |

| Brazil | 67 | 100 |

| India | 125 | 34 |

| South Africa | 37 | 16 |

The big question is how will US-China trade develop over the next couple of years. These figures reflect ongoing tariffs of China by the Biden administration. Nevertheless, both exports from and imports to China grew in terms of constant dollars after the first Trump administration. Exports are still roughly four times larger than imports, as they approach the half trillion mark. It appears that even under Trump’s unilateral tariff structure, China will get a more favourable access to US consumers than other countries. It seems likely that the new world trade regime will see less trade flows over $250 B, certainly Canadian and Mexican imports from the US will shrink below this benchmark. It will take much longer for the exports from Canada, Mexico or China to shrink below $250 B. New trade links are likely to pop up at the $50 B level within Europe, among Australia, Korea and Japan and from China to Brazil. The US is unlikely to strengthen any of its trade arrangements through its current trade policy but will likely see some onshoring of robotic or highly technical manufacturing. The value of the American consumer market will continue to grow, though some of those demands will be filled by American producers. It seems likely that future administrations will not have as free a hand as President Trump in setting tariffs – a role that the constitution clearly intended for Congress. Though the era of free trade has come to an end, the benefits of sending goods to foreign markets will remain and probably be reinforced over time.